Omar Nokta upgrades FRO, OSG, NAT

Oil Tankers Owe Strength to OPEC

Ruthie Ackerman

11.26.07

Forbes.com

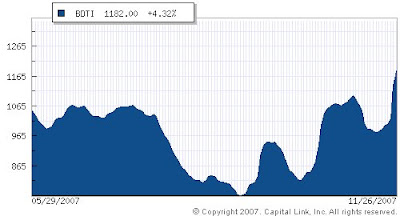

Increased oil production has sent spot charter rates surging on oil tankers in the last week, helping to keep the stocks of crude oil tankers and operators above water.

On Monday, Dahlman Rose & Co. analyst Omar Nokta, upgraded three tanker companies because they are the most exposed to the strong spot rates. Nokta raised his rating on Frontline, Overseas Shipholding Group, and Nordic American Tanker Shipping to “buy” from “hold” and reiterated his “buy” rating on General Maritime, Tsakos Energy Navigation, Ship Finance International, and Omega Navigation Enterprises.

But even with the upgrade oil tanker stocks were a mixed bag at the close on Monday, indicating investors didn't share Nokta's optimism.

Notka said the spot rates on the Very Large Crude Carriers, or VLCC’s, have jumped in the Arabian Gulf in the past few days. Last week, VLCC’s averaged $33,000 per day. On Monday morning they spiked to $84,000 per day, a level not seen since August 2006. The number of vessels being chartered has jumped significantly, limiting the supply of ships, Nokta said.

The strength in the oil tanker market has spread to West Africa and the Mediterranean as well, he added.

The problem for oil tanker lines over the last year has been that the supply of ships outstripped the demand for oil. With oil prices at record highs since OPEC's production cut in Nov. 2006, demand for oil tankers fell.

But Nokta believes the strong demand for oil tankers over the last few weeks is a result of increased production from the Organization of Petroleum Exporting Countries. As global oil stock levels have fallen over the past six months, OPEC has been under pressure to increase production. OPEC appears to have raised production by 750,000 barrels, Nokta said, which is more than the 500,000 barrel boost it previously announced.

Nokta believes the increased production is a sign that a formal boost should come when OPEC meets on Dec. 5. With gasoline, U.S. heating oil, and crude oil stockpiles down substantially there should be a significant amount of imports through the winter and into the spring, boosting the demand for oil tankers, Nokta said.

The conversion of 60 VLCCs into dry bulk carriers for 2008 and 2009 should offset a significant number of the 36 new VLCCs being built and the 69 more being delivered in 2009. With increased production in the Arabian Gulf demand will increase helping the tanker market to outperform expectations, Nokta said.